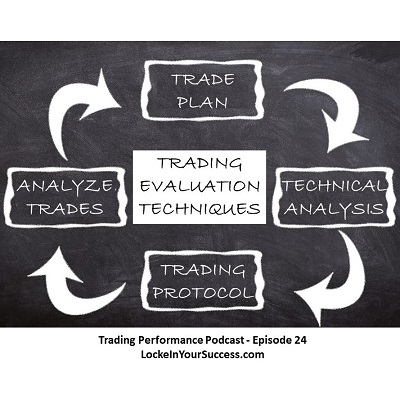

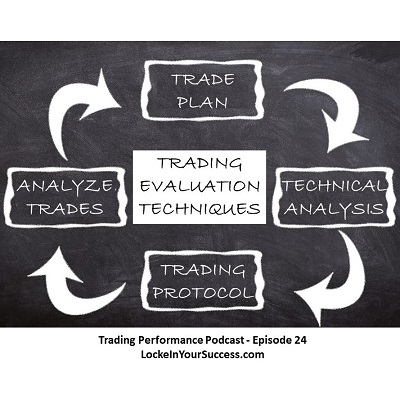

What trading evaluation techniques are you using? In this Trading Performance Podcast episode you will discover some of the advice that was shared on this topic during a recent GO Ask A Trader session. This valuable information will help you level up your trading! Click here or in the video below to gain some new perspectives on trading evaluation techniques.

When you start to evaluate your trading decisions, make sure you get a beneficial answer by asking questions in multiple contexts. What are you really asking? Based on what context?

Below are three primary contexts that trading questions are often based on. Think about how the answers to a question might vary based on each context:

- Did I make the right decision based on technical analysis?

- Did I make the right decision based on good trading protocol?

- Did I make the right decision based on analyzing the results after the trade has closed?

To bring more awareness to these contexts please consider the following:

1. When we are looking at the technical analysis and we are very confident about what is likely to happen in the market. We call this a high level of certainty.

However our certainty levels shift as new information enters the market place. Doesn’t it?

When you start to gain a higher level uncertainty it does make sense to reduce your risk or exit the trade. Keep in mind that a single result in this game of chance (trading) doesn’t really mean anything.

2. Good trading protocol is very important!

If you are following bad trading protocol it will eventually come back to hurt you in the future. It is going to create bad habits, and bad habits are going to result in bad trading results over time.

Following good trading protocol will get you very successful in the long run. We offer many resources on this topic if you need help!

3. Analyzing trading results after trading your plan consistently over time is the only way to know if the trade plan we used is a winner.

One of the most important factors in evaluating your trading is whether or not you consistently follow your trade plan and analyzing the long average results you are getting from following that trade plan consistently. If you continuously change the trade plan, then results are meaningless and there is no way to know if it is a winning trade plan. Plan your trade and trade your plan!

RESOURCES FEATURED IN THE SHOW

Grab a copy of the book Limitless: Upgrade Your Brain, Learn Anything Faster, and Unlock Your Exceptional Life by Jim Kwik or click here to review other recommended reading.

Want to join the GO Ask A Trader sessions? Become a PRO or GO or a Trading Performance member!

Leave a Reply

You must be logged in to post a comment.