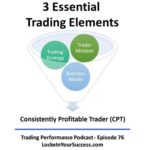

These 3 essential trading elements are like a stool with 3 legs. If you are missing any one of them, it will cause your trading business to tumble and fall. Review your trading business now! Does it have them all? Click here or in the video below to find out if you have all 3 […]

Trading Business

Ways To Get A Million Dollars

There are many ways to get a million dollars. One way would be winning it. Another way might be having someone give it to you. Most people be thrilled to receive a million dollars in such a way but, what are the longer term consequences? How about having someone teach you how to make a […]

Trading For A Living Successfully! (Part 2)

In Trading For A Living Successfully! (Part 2) we carefully review a case study of a person who would like to become a trader full-time and how we would coach them to look at their financial situation in making that determination. In this episode of the Trading Performance Podcast we provide an excerpt from The […]

Trading For A Living Successfully! (Part 1)

Trading for a living successfully can be done. It does take careful planning and preparation. In this episode of the Trading Performance Podcast we provide an excerpt from The Trading Triangle course where I teach traders about creating successful trading businesses. Click here or in the video below to learn more! Subscribe: YouTube Locke In Your […]

Do I Qualify?

Trader Tax Status can be a HUGE tax saver! Listen in as Kim Landry, CPA from Landry and Associates helps to clarify this important distinction. Gain access to great webinars like this one by becoming a Premium member of the Locke Options Community: https://www.lockeinyoursuccess.com/locke-options-community/

Trader Tax Status Benefits

Do you want to keep more of your trading profits? Learn how trader tax status can benefit you in this clip from a Bonus session for our Premium subscribers. Learn how to become a member: https://www.lockeinyoursuccess.com/locke-options-community/