What is options trading? It can be difficult to explain but it is most commonly compared to buying insurance. I know buying insurance doesn’t sound exciting but stick with me for a minute, I will make this exciting and break the explanation down as simple as I can.

Options are traded against specific stocks, ETFs or indexes. Buying options is different from buying stocks because when buying stocks you are buying a piece of a company. When you buy options, you are buying the right to buy or sell the stock or ETF at a specific price by a specific time.

Here is where the options trading meets insurance is exciting. Imagine you just bought your dream car, maybe it is a BMW and you want to protect it right? So you buy insurance to protect the money you have invested in the car. The insurance cost is an expense to you to protect your investment.

Now think of this scenario where you bought 100 shares of Disney stock at $100 per share. You might want to protect that $10,000 Disney stock investment like you protected your dream car. You could buy a put option. This would give you the right, but not the obligation, to sell the Disney stock at an agreed upon price on or before a specific date.

Who will sell you the put option to? Any other trader who is willing to be paid to take on the risk of having to buy your Disney stock at the agreed price on or before a specific date.

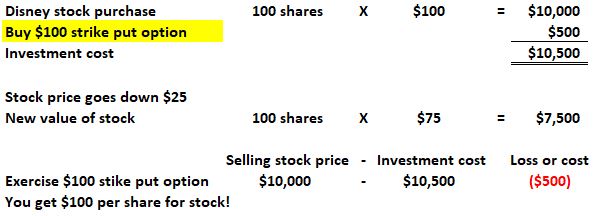

How do I utilize options in trading? There are many ways but for our example we will continue with our current Disney stock scenario. You have 100 shares of Disney stock at $100 per share with a total investment of $10,000. Then you buy a $100 strike put option for $500 as insurance for your investment for a total investment cost of $10,500. Let’s see what happens when the stock price goes up or down with and without options.

Here are two examples:

Example 1 – Your Disney stock that you purchased for $100 per share, goes up in value to $125 in the future. You decide to sell the stock at $125 per share which would give you a $2,000 profit as shown below.

In the example above you can see that if you hadn’t purchased the $100 strike put option you would’ve made another $500 profit, but the $500 is an expense to protect your investment. However there is always the chance the stock price will go down which is why you might want to consider protecting your investment. The next example might make you smile..

Example 2 – Your Disney stock that you purchased for $100 per share, goes down in value to $75. You decide to exercise your $100 strike put option. This allows you to sell your Disney stock for $100 per share even though Disney is currently trading at $75 per share meaning in this case that you’ve recovered the original cost of your Disney stock purchase of $10,000 minus the cost of the $500 that you paid for the put option. See the math below.

In the example above if you hadn’t purchased and exercised the $100 strike put option you would’ve lost a total of $2,500 if you had sold the stock at $75 per share. Was paying the $500 (insurance) cost to protect your investment worth it to you?

With options trading money can be made whether on either side of the put option. Of course there are risks associated with trading options but there are risks with trading stocks as well.

More good news with options trading is that you don’t have to own stock to trade options and the cost of trading options is a lot lower than buying stock. Options trading is all done virtually so transactions can happen very quickly and can be done from anywhere you have access to an online brokerage account. Even when vacationing at Walt Disney World!

Leave a Reply

You must be logged in to post a comment.