“Cheeseburger, cheeseburger, cheeseburger” – John Belushi, SNL

Remember that scene? You could order whatever you wanted at Billy Goat Tavern, but it would come back to you as a cheeseburger. That’s how I felt when I first started trading in mid-2012. No matter what I ordered from the trading gods, I just didn’t get what I wanted. We’ve all been there before. The secret is to figure out how to get out of that rut.

If I had to break down my personal trading journey, it can be grouped in three phases:

Phase 1 – The Confused State

After the excitement of working in my pajamas and having to walk to the next room as my commute to work wore off, I realized that CNBC, the twelve newsletters and the many seminars I had attended were not helping my P&L. My go to trade during this phase: Selling Iron Condors

Phase 2 – The Tastytrade Way

Finding Tastytrade was a breakthrough for me. Tastytrade does an excellent job in educating one how to trade by selling premium using high probability strategies. Through Tastytrade and their market measure segments I really progressed as a trader. My go to trade during this phase: Selling Strangles and Straddles on over 50-70 underlyings.

Phase 3 – John Locke’s Trading Style

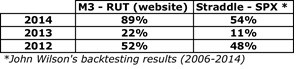

Feeling more confident and starting to trade in normal clothes at my wife’s request, I finally found the perfect fit for how I wanted to grow my P&L. It was the M3 trade that opened my eyes. At the APM course in New Hampshire in Spring of 2015, I learned not only how to improve my performance with the M3 trade, but I also learned how other traders (more intelligent than me) have chosen to only trade the M3. The thought of just trading one underlying blew me away. So, to prove it to myself I backtested my “go to” trade, the Straddle (the weapon of choice pre-APM course) with the M3 results posted by John Locke. Here is what I found:

Just eyeballing these numbers, one may think the results are fairly similar except for 2014, but it’s the difference in risk to reward. By back-testing the M3 as well I discovered that the drawdowns were far less than those for the Straddle and Strangle. If you don’t believe me, do it yourself. It’s impressive while still making a higher return. Now, why do I talk about the Straddle and Strangle? Those are some of the most profitable high probability strategies out there. However, the fact is there’s another trade out there that performs much better and that’s the M3! As a fulltime trader I feel confident that my P&L will grow each year. I just now have to figure out how I can eat cheeseburgers…my wife is a nutritionist.

Written and contributed by John Wilson

Leave a Reply

You must be logged in to post a comment.