Listen as John Locke analyzes the current market conditions and makes calls on what is most likely to happen next. Follow along through the sample trades of the Bearish Butterfly, M3, Rock, and V condor with adjustments. Questions are always welcome! Consider joining the Locke Options Community where over 350 talented traders hang out […]

options strategies

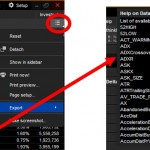

AutoHotKey

Jay sent us more information for those who are interested in learning more about AutoHotKey macro scripting. Go to https://autohotkey.com , scroll down to the bottom there are a list of resources, or go to: https://autohotkey.com/docs/AutoHotkey.htm for documentation. Another macro utility which is popular is: https://www.autoitscript.com/site/ Jay is also considering selling a compiled version of the package […]

What? I need more than a hammer in my trading toolbox?

I remember my first Investools class. My pencils were sharpened and my mind was open. It was a big day. I was about to be given the map to the holy grail of financial freedom. By lunch break, I was bursting at the seams to tell someone all about that beautiful trade with the funny […]

Stock Options Trading for Income with John Locke 3-07-16

About halfway through this week’s presentation John asks an important question “What type of trader are you?” Watch and find out more… Watch as John Locke analyzes the current market conditions and makes calls on what is most likely to happen next. Follow along through the sample trades of the Bearish Butterfly, M3, Rock and […]

Connecting ThinkOrSwim to Excel-Part 3 of 4

Written and contributed by Rich Kaczmarek Part 2 explained Excel’s RTD function and how it interacted with ThinkOrSwim (TOS). Excel’s UPPER function was introduced, we indirectly referenced a symbol and a ThinkOrSwim directive, and you learned a clever way to copy equations to new cells so Excel would modify just the parts you wanted modified […]

Connecting ThinkOrSwim to Excel-Part 2 of 4

Written and contributed by Rich Kaczmarek The last article covered some DDE versus RTD technobabble and left you with an example of how to use RTD in Excel to get the last price of RUT from ThinkOrSwim (TOS). Not bad for a day’s work but let’s take it to the next level. Before we begin, […]