Written and contributed by John Wilson, Successful Options Trader of the Month

Isn’t that a beautiful picture…the almighty American cheeseburger? Since I am married to a nutritionist, I can’t touch…just look. I’m not even sure the concept of “super-sizing” still exists. Then again, I don’t want to know.

Today’s blog deals with “super-sizing” your trade. What is this? Why is it important? Does it make me look fat?

To get you in the “sizing” mood, here’s a little clip from Chris Farley’s “Fat Guy in a Little Coat” segment from the movie, Tommy Boy:

So, you finally have a strategy or a set of strategies nailed down. To get that far, well, it takes a lot of work. Go ahead and pat yourself on the back. You deserve it. You are now ready to dive into trade size allocation.

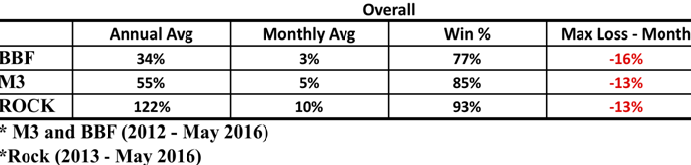

To help, let’s use the below strategies. If you were given these numbers, what would you do?

(The above are the result of the real time, hypothetical trades as tracked in the Options Trading for Income Weekly Update on our blog. Trades are real time simulated trades. Simulated trades are believed to be represented as accurately as possible, however live results may have been different. This summary is shared as an example for educational purposes ONLY, it does not imply that the information stated is accurate nor that it is possible.)

BBF = Bearish Butterfly – 2 month trade; $100K tied up capital ($50K per month)

M3* – 2 month trade; $50K tied up capital ($25K per month)

Rock – 1 month trade; $50K tied up capital ($50K per month)

(*) the M3 is a two month trade, but with capital reduction techniques learned in the APM course, it can be traded as a one month trade in terms of tied up capital.

If the above returns look familiar, they should as they were taken from this website where John Locke posts his weekly webinars. Thanks to Kas Uccles who took the time to break them down into a quick and easy guide using the above parameters. The BBF’s posted results were cut in half since the two month trade requires double capital, while the M3 and Rock posted results were not changed.

If you are new to the John Locke world, here’s a quick summary of the above strategies as they each have their specialties:

BBF: Bearish strategy, very high theta, high gamma trade

M3: Market neutral strategy, good theta, low gamma trade

Rock: Market neutral to bullish strategy, high theta, medium gamma trade

How would you size such a portfolio? I cannot answer that question for you. Sorry for ruining the punch line, but it’s true. There are just too many variables: ie. risk tolerance, portfolio size, profit goals, etc. We all would do it differently. However, I can help by saying that a mix of the above strategies will do quite well over the long haul. In addition, it’s easier to stay small in the beginning since you can always ramp up.

Personally, sizing is something I am continuously working on in my portfolio. I prefer to use some of the strategies opportunistically (ie. Bearish Butterfly of BBF), while using the M3 and Rock as my core strategies. The size of the BBF for me would be much smaller than the Rock, while the Rock would be smaller than my M3.

Overall, trade sizing is a personal decision. My only advice to help any new traders is to keep your trade size small especially if you haven’t thoroughly back tested it. In other words, stay at the salad bar. When you feel confident enough, knock yourself out and supersize it…just stay clear of those bacon bits!

Happy trading!

Written and contributed by John Wilson, Successful Options Trader of the Month

Leave a Reply

You must be logged in to post a comment.