“But it’s a negative vega trade, so doesn’t it lose money as the underlying goes down?”.

File this with the Neiman Marcus cookie recipe, Nigerian scams and Mark Zuckerberg giving away money if you post a thank you. I’m not entirely sure why poor vega got such a bad rap; you never hear someone saying, “It’s a negative delta trade, so won’t it make money on the way down?”. Both statements are equally overly simplistic and can be either right or wrong depending on other factors.

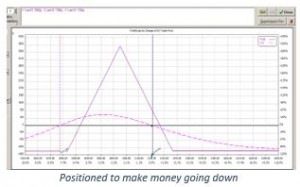

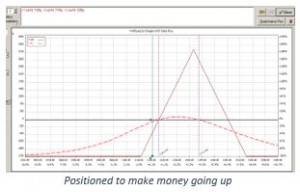

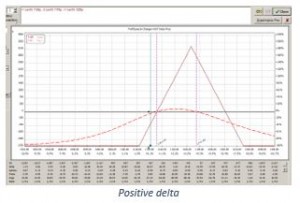

Consider positioning. A butterfly that is placed bearishly will obviously make money as it moves into the tent; one placed bullishly will likewise make money as it moves into the tent though in this case, it’s on an upward movement. Compare the T+0 lines in the next two figures:

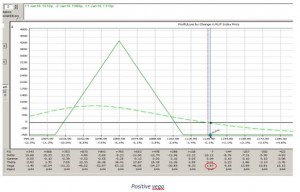

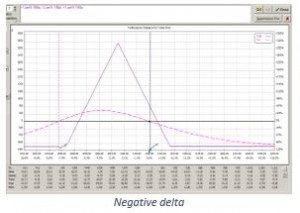

That’s just scratching the surface of the inaccuracy of the statement, though. Let’s look at the greeks. While it’s certainly true to say that a butterfly can be negative vega, there are also cases at which it is positive vega.

What the heck – let’s look at the other greeks. A butterfly can be either negative or positive delta, too:

So why does everyone fall into the old “it’s a negative vega trade and therefore loses money as the price drops and volatility increases” trap? Is it because everyone teaching this is wrong?

No, not really. The reality is that you have to start SOMEWHERE. Options are tricky little creatures and more complicated than they first appear. When you are first learning, to have a teacher or mentor say something this simplistic isn’t all bad. They’re probably talking about ATM butterflies and disregarding position, for starters.

The truth is that a complex option position can’t be looked at as a single, static set of greeks. It’s a composite of multiple strikes, held both long and short, mixed ITM, ATM and OTM, and each one will move independently of the others as the price of the underlying moves. Learning how the position’s greeks change with both time and underlying price movement is integral to improving your trading.

As a result, while we adjust by the greeks (delta or vega limits, delta/theta ratios, etc.), we manage the trade by the greek trends as displayed by the T+0 line (is my price movement risk acceptable?).

If you’re just learning butterflies, are trading ATM and managing by a set of rules, don’t worry about it. However, if you’re really trying to understand options trading, it’s time to let it go and consign it to Snopes.com.

Written and contributed by Cynthia Sarver

Leave a Reply

You must be logged in to post a comment.