We all know where that comes from. You guessed it, Jim Cramer. He is entertaining, but would I like to put my hard earned money into his recommendations? Considering his batting average is around 47%, I’d advise against following him or anyone for that matter. Regarding the network from which his program is aired, I have to admit that from time to time I do find myself listening to CNBC while driving in my car. Why do I do this? For two reasons: First, it can be entertaining. Second, I like to hear how many times the commentators on CNBC say “I think”, “I feel”, etc on air. Try it. You’ll be amazed.

As I’m throwing CNBC and Jim Cramer under the “this is how to make money” bus, let’s add to the list. It’s actually quite easy. You only have to walk through the financial section at the local bookstore to see the rows and rows of book titles aimed at quenching our thirst for financial freedom. Do any of them add any value? I don’t know, but given the way the average investor plays the market, I would say the proverbial dart-throwing monkey could do better; this list should also include the gurus, Warren Buffett and Benjamin Graham. Note: if you are a value investor at heart just stay with me for a few more minutes. I’m confident you may reconsider.

So, the question now becomes…what is an investor to do? Like most people, they could simply hire a money manager who will under perform the market while charging a fee, but they may sleep better at night knowing the onerous is on someone else. That’s how most of us manage our money.

Then, there’s the crazy idea of doing this all yourself without having to even watch any news, read any financial statements or seek any financial advice whatsoever. Sounds like an infomercial at 2am, doesn’t it? Too bad we couldn’t get the Shamwow guy to pitch the below John Locke trade. What is the trade?

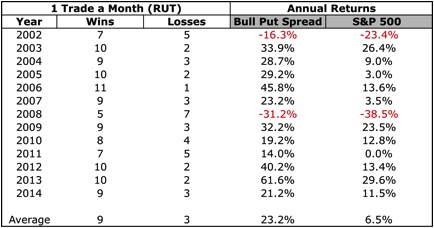

Answer: Sell a Put Spread on the RUT every month about two months out and close after one month. There are some small rules to follow but it’s basically a 5-minute trade per month. How hard it that? I know. It sounds too easy and unrealistic. An average 23% annual return since 2002-2014? Warren Buffett’s Bershire Hathaway return is just under 10% during that same time period. If I saw that at 2am, I’d change the channel too. Here’s the chart:

As you can see, this simple trade has outperformed the S&P 500 every single year during the time period of 2002 – 2014. It’s not sexy, but it works. This is just one example of the many John Locke trades that perform quite well in different market environments.

How is that possible? The reason is simple. You are selling volatility. As fear in the market increases, so do the premiums. We are not stock pickers here. For a stock picker to beat the market year over year, it would be virtually impossible. We are not saying this trade will not have a losing year to the market in general, but as you can see, it has done quite well during the above time frame.

What are these so-called rules to follow? Well, you won’t find them at a bookstore. The guidelines could fit on one of those airplane leaflets you see on the back seat pockets, but that may just put the passengers to sleep. Hey, I see some synergies here…Hmm.

So, the next time you find yourself meandering around the financial section at the bookstore or listening to CNBC for a stock trading tip, remember there’s a more practical way to make your money grow over time.

Written and contributed by John Wilson

Leave a Reply

You must be logged in to post a comment.