What is skew? What does it mean? How do we utilize it? These questions and many more are answered during this engaging Enriching Session with a supplemental lesson which contains well over two hours of instruction.

Questions on content? View the index!

| Time | Subject |

| 1:12 | What is an Options Skew? |

| 1:51 | Why do we care about Implied Volatility (IV)? |

| 3:09 | IV value is the primary factor that determines the odds of our trades and the effectiveness of our adjustments. |

| 3:44 | What is Implied Volatility? |

| 3:57 | An option’s value is made up of two primary components. |

| 5:24 | One point in IV is going to have a greater effect on closer to the money options than further from the money options. |

| 6:31 | What makes up Extrinsic Value? |

| 7:18 | What makes up Intrinsic Value? |

| 9:06 | Most Traders think the options price is affected by its IV – this is wrong! |

| 9:25 | Word Equations – words broken down into equations to figure out what their deep structure means. |

| 11:30 | What actually drives the Extrinsic price of an option? |

| 12:59 | Horizontal Skew, one of the primary types of Skews. |

| 13:55 | This particular chart does not mean anything unless you know three things… |

| 14:36 | What tends to happen when the market transitions from a relatively quiet market to a panic mode. |

| 19:30 | Actually your best calendar entry opportunities will be AFTER a surprise market shock following a low IV environment. |

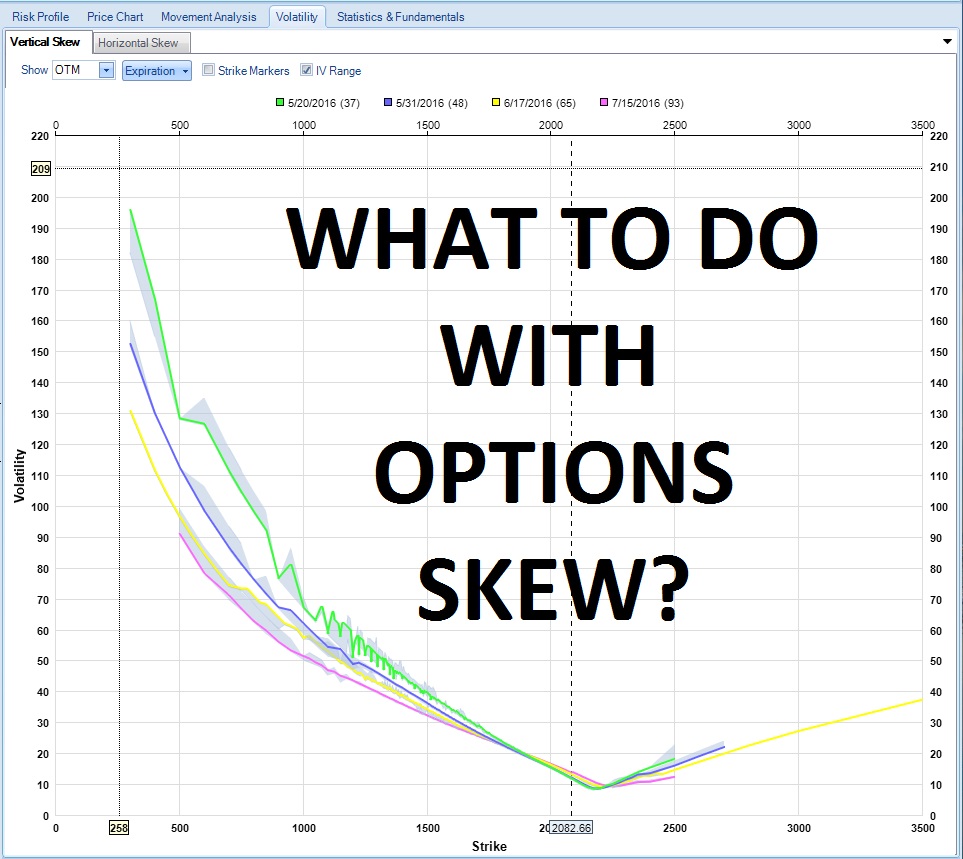

| 22:00 | Vertical Skew, one of the primary types of Skews. |

| 23:11 | Your typical Vertical Skew graph is going to look something like this. |

| 26:19 | Let’s take a look at a typical skew chart of the RUT 56 DTE in a choppy market. |

| 29:03 | Horizontal Shift – what is normal for horizontal skew? |

| 30:06 | Vertical Shift – what is normal for vertical skew? |

| 31:15 | Slope – what is normal for slope? |

| 37:27 | Putting it all together with the Theoretical Butterfly Example. |

| 47:32 | Convexity – What is normal for Convexity? |

| 52:00 | What does our Theoretical Butterfly Example look like on the skew curve through time? |

| 55:22 | Student comments that OTM IV is more accurate than that of the calls over puts IV. |

| 57:48 | What does our Theoretical Butterfly Example look like on the skew curve through an up move? |

| 1:00:44 | What does our Theoretical Butterfly Example look like on the skew curve through a down move? |

| 1:04:00 | A review of what happens with a 56 DTE Theoretical Butterfly Example as the market moves up or down and volatility changes. |

| 1:05:54 | A review of what happens to the Slope of the Skews as the market moves up or down and volatility changes. |

| 1:07:16 | What are the typical reasons for Vertical Skew to become a smile or a frown? |

| 1:10:55 | Does OptionVue or OptionNET Explorer T+0 line take into account changes in Skew as the market rises or drops? |

| 1:13:12 | How can you possibly estimate changes in Skew with a piece of analytical software? |

| 1:16:09 | As an M3 Trade approaches expiration and your upper long strike is getting into the ‘hook’, would it be a good time to roll the upper longs back or convert to a Broken Wing Butterfly? |

| 1:19:49 | I noticed that the slope of the Vertical Skew changes a lot from mid-day to the time we make our adjustments toward market close. |

| 1:22:39 | Here are some links to a few videos on Vertical Skew, Implied Volatility and Weighted Vega. |

| 1:23:54 | As a beginner M3 Trader if you are not profitable in the market and comfortable with what you are doing then this is stuff (Skews) you should be ignoring. |

| 1:25:36 | Is it possible to create my own T+0 line in OptionVue based on the estimated IV of individual options when the market drops say 40 points? |

| 1:25:57 | I thought that the ‘hook’ was not miss-pricing but occurs due to the fact that OTM options lose value more slowly as we approach expiration? |

| 1:31:26 | Can this information on Skews help determine when it is a good environment for M3 vs. BWB and if SPX is better to trade than RUT? |

| 1:33:29 | Time premium is calculated off of mid price which is generally not accurate for deep ITM options, is that why we see the issue of time premium not being correct for Deep ITM options? |

| Time | Subject |

| 0:07 | Here is an overview of why this supplemental was created and what it will cover. |

| 1:19 | Here is the setup for a standard 50 point butterfly in RUT and an explanation of what you are seeing. |

| 2:36 | This is a review of how ATM options are affected by volatility changes and a brief review of skew. |

| 3:40 | Here is what happens to the value of our ATM butterfly when we get a volatility increase. |

| 5:15 | Here is what happens to the value of our butterfly when we get a volatility increase and our upper long strike is ATM. |

| 6:30 | Here is what happens to the value of our butterfly when we get a volatility increase and our lower long strike is ATM. |

| 7:00 | Here is what happens to the value and implied volatility of our ATM butterfly when the market moves up 50 points. |

| 9:11 | Here is what happens to the value and implied volatility of our ATM butterfly when the market moves down 50 points. |

| 10:54 | Sometimes we get a change in the Skew line that causes it to Curve. Here is how the Curve in the skew line effects the butterfly. |

| 12:48 | What happens if we get a Skew Curve in the other direction or a frown line? |

| 13:58 | Let’s see what happens if the market moves up 50 points and we have a ‘Smile Skew Curve’. |

| 15:28 | When you get into a position like this, generally you do not want your long option up on the ‘Hook’. |

| 17:50 | Let’s take a look at no price movement and just general Implied Volatility gains and losses. |

| 21:34 | What happens to our butterfly if our lower long strike is ATM and we experience changes in Implied Volatility? |

| 27:08 | What happens to our butterfly if the market panics?!? |

| 31:09 | What is going to happen to the value of our puts in the butterfly when we get a market reversal? |

| 33:56 | What can we expect from a very low volatility environment? |